Table of Contents

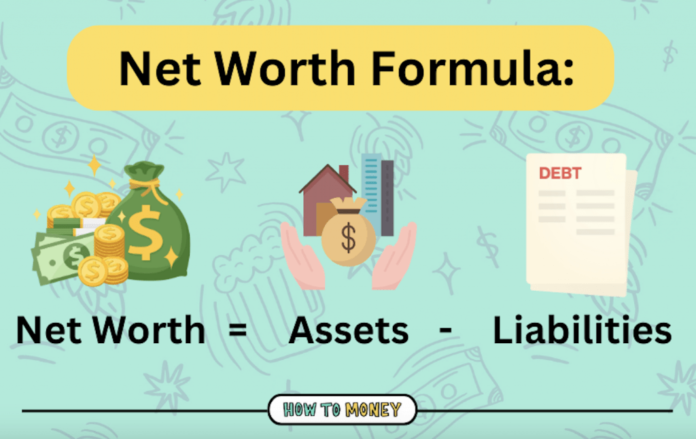

Net worth is an important number that helps you understand how much value you really have. It’s calculated by subtracting the things you owe (liabilities) from the things you own (assets). Knowing your net worth can give you a clear picture of your financial health, whether you’re doing well or need to make changes.

If your net worth is positive, it means your assets are worth more than your debts, which is a good sign! However, if your liabilities are higher than your assets, you might have a negative net worth. This can be a warning that your financial situation needs attention.

What is Net Worth and Why is It Important for Your Financial Health

Net worth is a number that helps you understand your financial situation. It tells you how much you own compared to how much you owe. To calculate it, you simply subtract your debts (liabilities) from your assets (things you own, like a house or savings). If the result is a positive number, it means you have more assets than liabilities.

Knowing your net worth can be very helpful in managing money. It gives you an easy way to see where you stand financially. If you have a positive number, it shows you’re in a good place. But if it’s negative, it might be a sign that you need to make changes to improve your financial situation.

Your net worth is like a report card for your finances. It helps you figure out if you are saving enough money, paying off your debts, or if you need to start making some adjustments to your budget.

How to Easily Calculate Your Net Worth

Calculating your net worth can be simple. First, list all your assets. These are things like your house, car, and savings. Then, list all your liabilities—things like loans, credit card bills, or a mortgage. Once you have these lists, subtract your liabilities from your assets to get your net worth.

To get an accurate number, you should consider the current value of your assets. For example, if you own a house, check its market value, not what you paid for it. The more accurate your asset values, the more accurate your net worth calculation will be.

- List all assets (house, car, bank accounts)

- List all liabilities (debts, loans, bills)

- Subtract liabilities from assets to get your net worth

This simple calculation can give you a clear picture of your financial health.

Assets vs. Liabilities: What Should You Include in Your Net Worth Calculation?

When calculating your net worth, it’s important to know what to include in your assets and liabilities. Assets are anything that can be sold or used to gain money, like property, cars, or bank accounts. On the other hand, liabilities are what you owe, such as loans, credit card debt, and mortgages.

Your assets could include:

- Real estate (homes, land)

- Vehicles (cars, motorcycles)

- Savings and investments (bank accounts, stocks)

Your liabilities include:

- Mortgages

- Car loans

- Student loans and credit card debts

By understanding the difference between assets and liabilities, you can make a more accurate net worth calculation.

How to Improve Your Net Worth Over Time: Simple Steps

Improving your net worth doesn’t have to be difficult. Here are a few simple steps you can follow:

- Increase your savings: Try to save more money every month. Even small savings can add up over time.

- Pay off high-interest debts: Focus on paying off credit cards or loans with high interest. This will help reduce your liabilities.

- Increase your assets: Consider investing in things that can grow in value, like stocks or real estate.

- Live within your means: Try not to overspend. If you spend less than you earn, you can use the extra money to pay off debts or save for the future.

Improving your net worth is about being mindful of how much you save, how much you spend, and how much you owe. The more you save and pay off debt, the stronger your financial position will become.

Understanding Positive and Negative Net Worth

Your net worth can be positive or negative. A positive net worth means you have more assets than liabilities, which is a good sign of financial health. On the other hand, negative net worth means you owe more than what you own. This is a situation you’ll want to avoid, as it can make it harder to achieve financial goals.

- Positive net worth: Your assets are greater than your debts.

- Negative net worth: Your liabilities exceed your assets.

If you have a negative net worth, it’s important to take steps to reduce your liabilities or increase your assets. Managing your money better and reducing debt is key to improving your financial health.

Why Tracking Your Net Worth Can Help You Make Smarter Money Choices

Tracking your net worth over time is a smart way to make better financial decisions. When you know where you stand, you can make informed choices about your money. If your net worth is growing, it means you’re on the right track. If it’s decreasing, you’ll know it’s time to adjust your budget or spending habits.

- Helps you understand if you’re saving enough

- Shows if your financial health is improving or declining

- Guides you in making better financial decisions

By tracking your net worth, you stay aware of your financial progress. This awareness can help you make smarter money choices, like saving more, investing wisely, or cutting back on unnecessary spending.

The Connection Between Net Worth and Wealth Building: What You Need to Know

Building wealth starts with understanding your net worth. By tracking your assets and liabilities, you can see how your financial situation is evolving. A positive net worth is the first step in creating long-term wealth. The more you grow your assets and reduce your liabilities, the stronger your financial position will be.

Here’s how net worth plays a role in wealth building:

- Growing your assets (investments, savings)

- Reducing liabilities (debts, loans)

- Setting financial goals to improve your net worth over time

Wealth building is a gradual process. By focusing on increasing your net worth, you’re taking steps towards a more secure and prosperous future.

Conclusion

In conclusion, understanding and tracking your net worth is a great way to keep an eye on your financial health. Whether your net worth is positive or negative, knowing the number can help you make smarter decisions about your money. By calculating your net worth regularly, you can see if you are getting closer to your financial goals or if changes are needed.

If you want to improve your net worth, start by saving more, reducing debt, and growing your assets. It may take time, but with the right steps, you can steadily build a stronger financial future. Remember, your net worth is a reflection of your financial choices, so making good decisions today can lead to a better tomorrow!

FAQs

Q: What is net worth?

A: Net worth is the total value of everything you own (assets) minus what you owe (liabilities). It shows your overall financial health.

Q: How can I calculate my net worth?

A: To calculate your net worth, list your assets like savings and property, then subtract any debts or loans you owe.

Q: Is a negative net worth bad?

A: Yes, a negative net worth means you owe more than you own. It’s important to try and reduce your debt or increase your assets to improve your situation.